Retail Insights 2021

Retail Insights 2021

We are now in 2021 and we are all painfully aware of the elephant in the room- 2020 left a mark on the entire world. The new year which symbolizes hope, a fresh start, reaching new (or old and elusive) goals, shedding previous negativity, has never been more awaited and needed than from 2020 to 2021.

Everything was and is influenced by Covid-19. Every person and sector is impacted one way or another, by the pandemic. What was the impact on the retail sector in 2020, and how much impact will it have in 2021?

On an optimistic note, we see arising opportunities for brands and retailers. Read on to discover 8 retail insights and trends for 2021.

1. Investing in Brick & Mortar

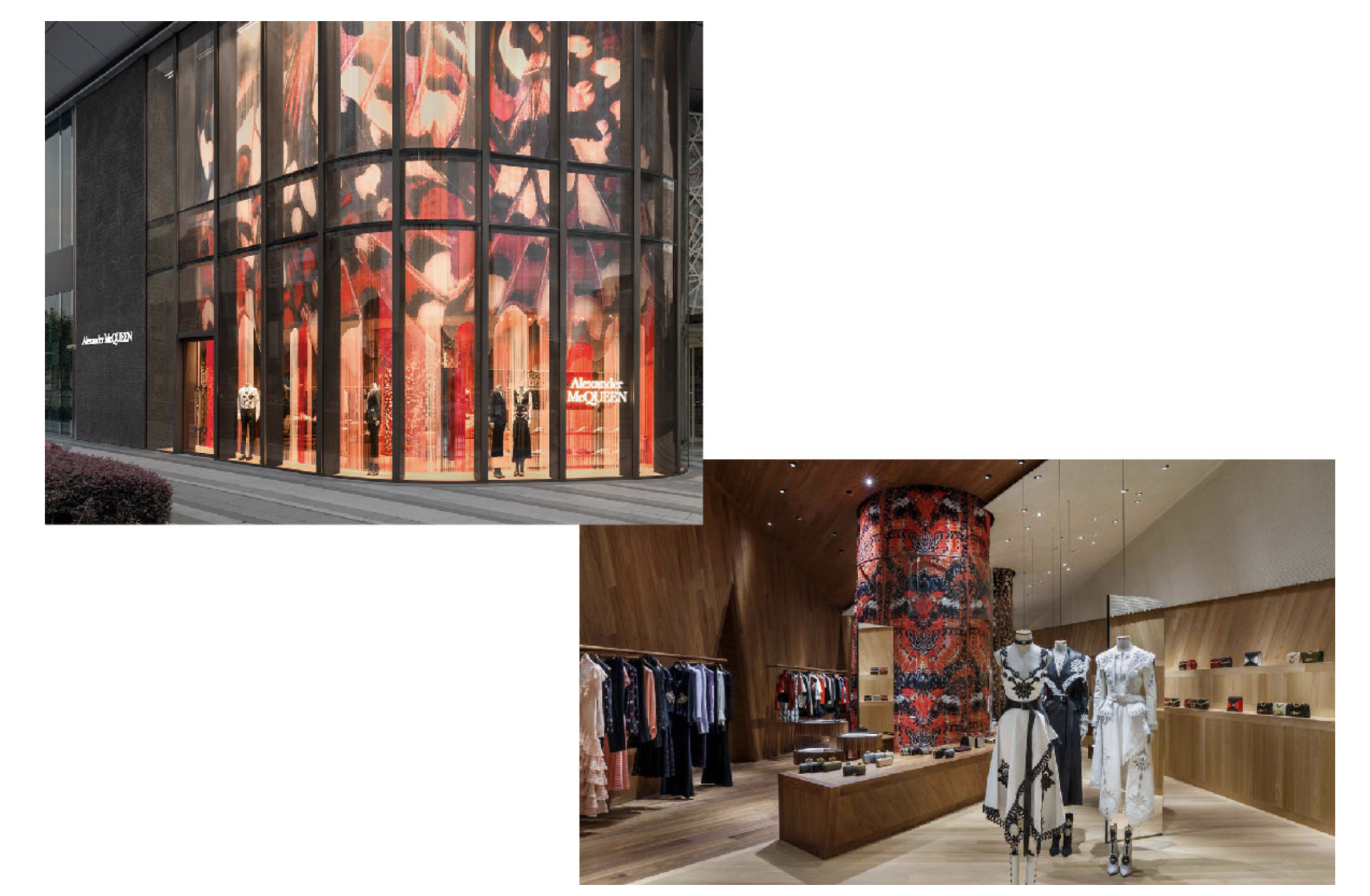

Alexander McQueen Store

Alexander McQueen Store

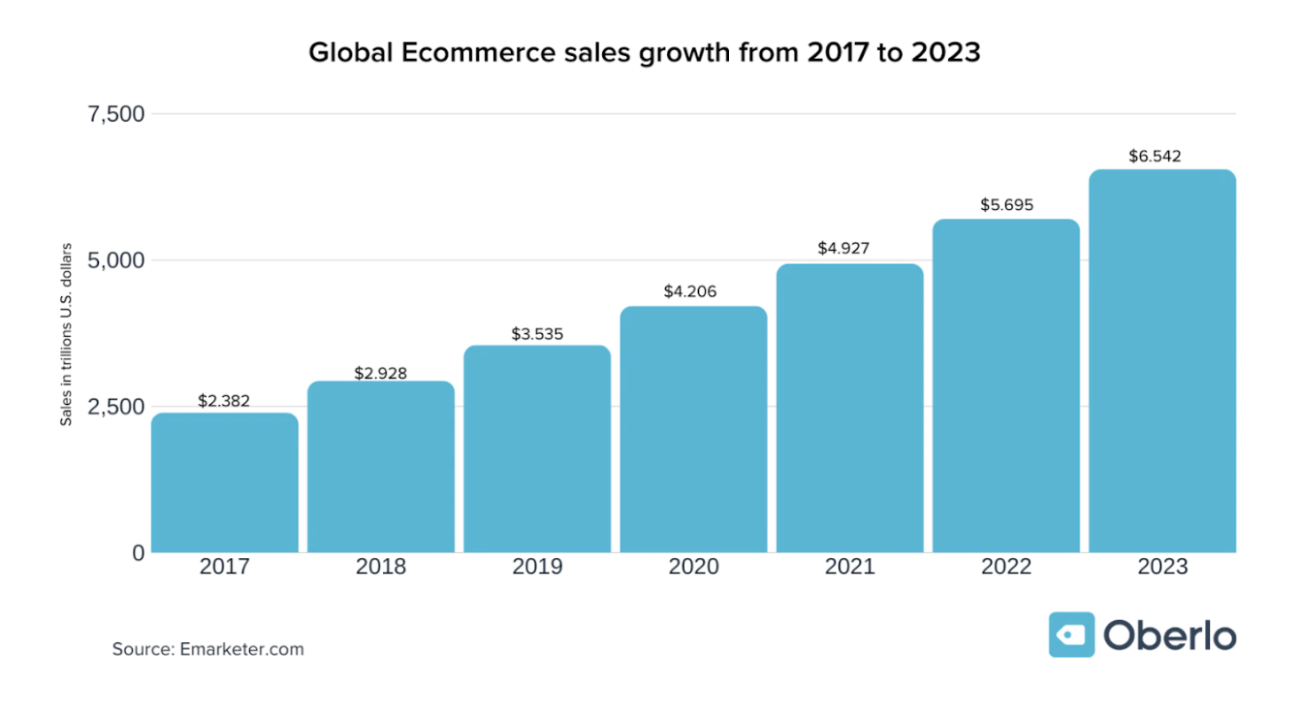

E-commerce had been growing exponentially over the last few years and was already becoming a big part of the way brands sold merchandise. The pandemic clearly accelerated this trend, however, it doesn't mean the end of physical stores.

Contrary to what one might think, the expansion of e-commerce does not mean the collapse of brick and mortar stores. As a matter of fact, more than 44% of consumers deeply want to go back to physical shopping. E-commerce sales will keep on growing but physical contact, the touch and feel and being wowed by the experiential setup of a store is something that humans continue to crave. The expansion of e-commerce leads brands to rethinking their stores that now become the ultimate representation of a brand, its mission, and differentiating services it offers.

For obvious reasons, the retail sector had a difficult year with strict lockdown restrictions coming in effect around the world. Surprisingly, some brands have nevertheless decided to invest in brick and mortar.

According to Vogue Business, there is an interesting development concerning physical apparel stores in the US: a few luxury brands like Slowear, Loro Piana, Alexander McQueen and Chanel are actually grabbing the reins during the pandemic to open flagships and new concept stores throughout the country and are planning for their global expansion in upcoming years.

Cautiously looking ahead, the global apparel market is projected to grow in value from 1.5 trillion U.S. dollars in 2020 to about 2.25 trillion dollars by 2025.

This shows that the demand for clothing and shoes is on the rise across the world, and that’s just the apparel sector.

In 2020, retail industry sales only dipped 5.7% to 23.36 trillion US dollars, a small decrease from the previous year. Growth is predicted for 2021, with the market leaping to 25.04 trillion US dollars worth of sales.

2. Digitizing Cosmetics

The beauty sector — encompassing color cosmetics, fragrance, haircare, personal care and skincare — is proving more resilient than fashion with a faster recovery.

The market will be very different though, reshaped by the crisis and reflecting significant shifts across regions, categories and channels. These changes include trends that were already latent pre-crisis, but that are now materializing in three to five months as opposed to three to five years in pre-pandemic times.

Looking into the global fashion industry report The State of Fashion 2021, co-published by BoF and McKinsey & Company, the beauty industry's quick comeback will vary by region.

While Europe and Japan are only going to return to the 2019 sales levels in the first half of 2022 at the earliest, China has already surpassed the 2019 beauty sales in the first half of 2020 and has a forecasted 8 to 10 percent average annual growth.

The US market, on the other hand, shows a return to pre-crisis beauty sales during the first half of 2021.

The global shift to e-commerce for this sector caused McKinsey to predict a doubling in the market from just over 10 percent in 2019 to almost 20 percent by 2021.

This is also due to the increased engagement in social media and platforms like Instagram taking the main stage for online purchases innovations, with more in the works for the future.

Within the beauty sector, according to NPD, the haircare, skincare and personal care categories predicted to grow in 2021.

3. Omnichannel Experience

As we discussed previously, omnichannel is not an option anymore. Generally speaking, retail is becoming omnichannel. The alliance between the Chinese e-commerce giant Alibaba, the Swiss luxury group Richemont and the British online sales site Farfetch is a great example of what's to come. A 1.15 billion dollar operation carried out in the midst of a pandemic leaves us wanting to know more.

How to keep the same level of requirement across all channels? One of the things we've learned this year is that brands that adapt and reinvent themselves very quickly will come out as winners.

Some physical first brands embraced, in record time, 3D showroom or live streaming, customer service video chat or social shopping.

However, one of the challenges of 2021 will be to take a step back from the innovations and actions of 2020 in order to optimize online and physical experiences while keeping the human touch factor, challenged by the pandemic, and integrating it in digital channels.

4. The importance of Window Displays

Have storefronts become the new business cards for closed stores in COVID time?

In the developing post-pandemic urbanism, visiting a store has transformed into an adventure: the experience of going outdoors. More sophisticated solutions for managing traffic flow have started to take hold, like Philips' PeopleCount displays, an entrance solution that links a camera and screen to count store occupants. The solution tracks footfall, automates entry by letting passers know if the store is at full capacity, and doubles as a new marketing touchpoint with additional brand visuals displayed on screen. According to a press release in Business Wire "the system can be programmed to provide customers and staff with clear information around store capacity, alerting customers to whether it’s safe to enter the store by installing cameras at building entrances. These cameras will feed information on expected wait times, as well as engaging, promotional messaging onto the displays."

This is becoming more of a key point of interaction between consumers and brands, proving that this change in approach might not be temporary and cater to the evermore important consumer driver: convenience. According to a quote from Melissa Gonzalez, CEO of retail strategist The Lionesque Group in a FRAME article,

‘Shifting from visual to shoppable storefronts will be key in increasing the ability to monetize space, as well as add scalability in design investments. Display windows may also evolve in their purpose, requiring the ability to modulate from a point of visual display and storytelling to one centered around a purchase and/or pick-up

In the same article we discover that QR codes were used by Selfridges' The New Order to bring window displays to life for the passersby. They could explore and shop renderings of products, with mannequins dressed in 3D scans of apparel and accessories.

‘Windows used to be an advertising tool for products, but customers expect more now. Our aim is to create captivating scenes that are more like art pieces in their own right. For the future, the potential for holograms and live interactive digital experiences opens up a whole new world of possibility

Emily Outhwaite, Selfridge assistant styling manager

The New Order Selfridge display

5. A Demand-Focused Approach

Most people have realized they can live with the basics: jeans, t-shirt and mascara. Their sense of priorities have changed. Is it by chance that Chanel or Valentino are investing in literature? More products do not necessarily yield more profit. Brands should reduce inventory by taking a demand-focused approach for both new products and seasonal collections. A pre-order approach has been at the cornerstone of this shift. The idea is to produce only what customers order (no surplus = no sales = fair price all year round). Each new product is available for pre-order for a few weeks. Once the period is over, brands stop taking orders and start production.

The French influencer, Lisa Gachet, who created the brand Make My Lemonade, has recently chosen to launch an ultra-trendy Sherpa Sweater as a pre-order:

“Only a few hours left before the end of the pre-order ... tic tac tic tac ⏰”.

In marketing terms, this strategy is devilishly effective because it activates the phenomenon of scarcity in the consumer and creates a sense of urgency to purchase.

Brands will understand in advance the quantities that they need to produce, if you have not ordered on time, there is a possibility that you will not be able to purchase the article in the future. This technique also allows companies to know the quantities to produce, and how much material to order to reduce costs and have less waste at the end of the cycle.

6. Shop Local

A McKinsey article explains that companies need to engage better with new customers or customer groups they didn’t consider before, and make strategic investments in recovering markets to unlock new revenue opportunities.

Smaller brands have thrived via the #shoplocal and #supportlocalbusinesses during the COVID-19 pandemic thanks to the support of social media’s forward thinking accounts with big followings. One good example is Radhi Devlukia-Shetty and her Instagram Small Business Saturday Series in which she covers small sustainable brands and artists who she sometimes purchases from. Most of the brands are US based but ship internationally. She recently did a UK series to start the concept in Europe.

"Regular" consumers have also taken to engaging in local shopping and sharing their support of local businesses on social media by sharing their experiences with products and services.

Brands and businesses have also had to step up their game in order to survive. According to a research on the US market, by Society for Human Resource Management (SHRM) released June 23rd, 43% of small businesses rethought the way they did business, 32% found new ways of delivering existing services and 22% focused on training their employees in new skills to follow changes in the way they do business. Concentrating on local plus smaller businesses being more agile and adapted for change allows them to make a significantly faster recovery in the upcoming period than those forecasted by economists for larger brands.

7. Transparency

People are becoming more and more suspicious of large companies. They also have a stronger ecological conscience. Brands therefore have to seriously consider communicating on the traceability of their products, as well as the way they treat their employees.

According to VOGUE BUSINESS, Fashion Revolution analysed over 200 brands according to the level of publicly available information on their approach to social and environmental issues and practices, when building their 2020 Fashion Transparency Index. They found that brands are disclosing more about their policies rather than the actual implementation.

This coming year, transparency is more of a key focus for consumers. These types of issues are not new and were already present in the fashion industry. The pandemic simply emphasized their importance in consumers’ eyes.

In an article for FORBES, Maura Regan, President of global licensing industry trade association Licensing International, draws attention to the fact that trusting a brand is more important than ever in global markets. Transparency must become a priority. From supply chain to pricing and sustainability to employee relations, brands will have no choice but to meet expectations in addressing consumers’ higher standards and compete for dollars spent.

8. Staff Training and The Effective Usage of Visual Merchandising

As P. Halas, former VM assistant at Primark said, “VM is used effectively through triggering customers and simultaneously keeping an effective overview of stock, all this adds significantly to the overall profit.”

With a slowed-down retail rythme, companies should take advantage of training their VM teams for them to hit the ground running when life picks up again. VM will be able to deepen their skills in areas where they don’t usually have time to slow down for while allowing them to think about future strategies creatively and learn new techniques.

The lockdown restrictions are being softened throughout the world, or are gradually getting less constricting due to the vaccination rollouts. Optimistically, the light at the end of the tunnel is getting brighter and brighter. People cannot wait to go out and enjoy themselves with drinks, dinner and most importantly, shopping. Retail will benefit from reopening brick-and-mortar locations and VM that have anticipated properly will play a significant part in creating profit by applying their (new) skills.

You don’t know me but I am, like most of the retail sector, choosing to stay optimistic for 2021 despite the current situation! Now if you will excuse me, I have to find some wood to knock on."

MORE ARTICLES BY THIS AUTHOR

Caroline

I am a Brand Image leader working in Retail and tech passionate about 360° storytelling. I'm also keen on travel and wildlife. I have a strong experience in building and implementing communications strategies (consumer, corporate, BtoB, social media) consistent with marketing levers and business needs. I have always been working in fast-paced environments and have experienced early days of companies that have known tremendous growth.

.jpg?width=330&name=BLOG%20COVER%20(2).jpg)