Separating stores and online operations

Separating stores and online operations

In the past few months, several major US retailers have started conversations about separating their store business from their e-commerce activities. This has generated considerable discussion within retail circles.

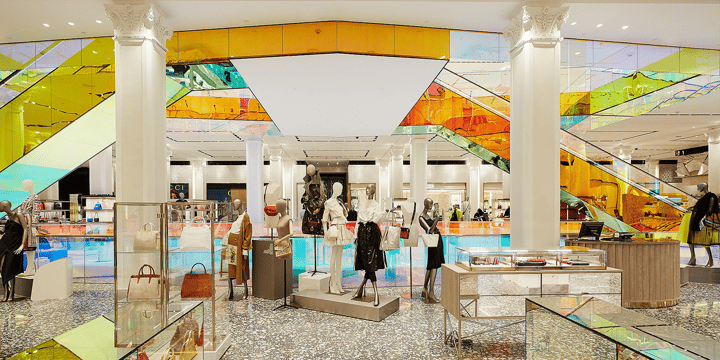

HBC, the owners of Saks Fifth Avenue, announced in March this year that they would separate their online business from their portfolio of 40 stores. The HBC CEO, Richard Baker, stated that an IPO of the ecommerce business, called ‘Saks’ makes great sense.

Hot on the heels of this announcement is news that Macy’s has been advised to separate the two retail channels by investment firm Jana Partners. They believe the ecommerce arm of Macy’s could be worth up to $14bn, "Macy's could see an increase in its stock price by 100% if it followed the playbook of Saks," Jana Partners portfolio manager Scott Ostfeld said.

Image Bloomberg

This presents a fascinating junction for established brick and mortar retailers, as they see their online business growing rapidly. Investment businesses and financial experts see an opportunity to separate operations to make short term financial gains.

The increasing concerns of retail experts, is the potential danger it presents to the seamless shopping experience that most retailers are striving to deliver to customers.

In recent years, we have seen the maturing of digital offers, as websites, social media and apps become established as well as integrating with the physical store.

Shoppers are more aware of the options available to them, provided by brands. We are now seeing customers stand in the store using their phones to complete purchases.

This begs the question, what does this mean for retailers looking to cash in and separate stores from their digital business? Macy’s CEO Jeff Gennette has stated:

“Our commitment to delivering a dynamic seamless omnichannel experience across the customer shopping journey has never been stronger.”

This is an obvious thing to say, to reassure investors, and more importantly, customers. But how will this be achieved, when separate operations will have their own budgets, activities and agendas?

As seen in many cases, retailers are struggling to create this seamless and merged retail experience. A retailer should have a unified tone of voice with the same products, prices, promotions, delivery and message, across all channels. This is easy to write and say, but is a massive logistical challenge particularly when traditional businesses have siloed departments with separate agendas, targets and responsibilities.

We are, however, seeing retailers successfully merge different channels for the benefit of their customers. One example is Fast Shop in Brazil. This consumer electronics store offers physical product demonstrations after which shoppers can order in store and have Uber deliver the order to their home within two hours. This is a great example of how stores can be leveraged for online sales, where both channels combine for the benefit of the customer.

Image Nelson Kon

Uniting several departments for the benefit of shoppers is the type of customer-centric shopping experiences retailers should strive to develop. How will a retailer ensure this happens when the departments involved are further separated? Can we expect companies like Saks and Macy’s to improve their customer experiences and efforts to engage when parts of their business are owned and operated separately?

One of the challenges businesses face is the cost of ensuring that e-commerce ventures thrive, without the direct support of physical store presence.

Global Data managing director Neil Saunders, said that the separation of the businesses would be ill-advised. "An online only Macy’s would need to work incredibly hard to differentiate itself against Amazon and many other players. And if it were not able to rely so much on stores for visibility and customer connection it would need to spend an enormous amount on customer acquisition and retention."

In the UK, the department store Debenhams closed. In January 2021, online fashion retailer Boohoo purchased the brand and it’s website, but closed all 52 stores. At the time, the Debenhams website was ranked in the top 10 retail websites in the UK.

Image Telegraph UK

This creates a contrasting situation... How much does a department store brand rely on the physical stores for its brand image, customer awareness, and sales? While the digital business is growing fast and hasn’t yet found it’s natural position within the retail space, it may still benefit from the support of physical stores that established the brand’s identity in the first place.

Only time will tell, as we watch with interest to see how Macy’s, Saks and Debenhams develop their business, with the separation or closure of different channels.

Header Image PRNEWSWIRE

About Ian Scott

With over 20 years of experience within the Retail and POP sectors, Ian can provide a fresh perspective, always with the viewpoint of your shopper and customer in mind. By combining a global understanding of retail, combined with developing innovation and measurement of ROI, he can help you gain clarity on your retail strategy and help deliver actionable and measurable solutions.

Never miss out on latest news in the retail industry on Facebook, LinkedIn or Instagram.